US Corporate Law 20 Episodes (20)

VIE Structure Cayman Islands | Your company is not a VIE at all.

In the last issue, we discussed the concept of different rights in the same shares that entrepreneurs often misunderstand. Today, let's talk about another misunderstood concept - the VIE structure.

1. Introduction to the structure

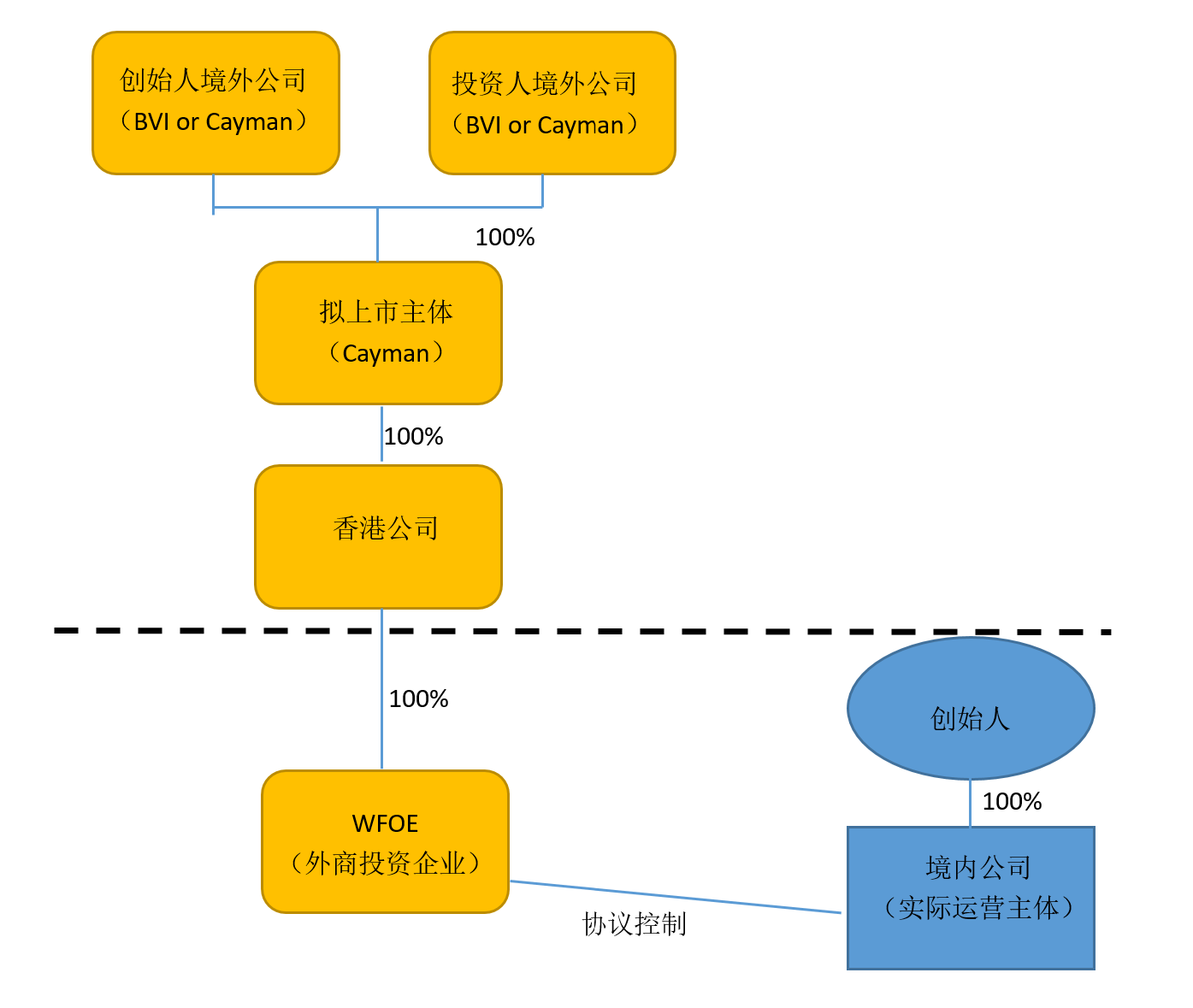

Here is a basic diagram of a VIE architecture.

(1). At the top are two offshore companies, one for the founder and one for the investor. Of course, this is our simplified structure. If you have multiple investors, there may be more offshore companies at the top.

(2). The second layer is the company that we really want to become a listed entity next, which is also an offshore company. You will find that the top holding offshore company can be either BVI or Cayman, but the main listed company is often Cayman. Because the mainstream stock exchanges do not accept the listing of BVI companies, the listing entity is often registered as Cayman.

(3). The third layer is the Hong Kong company. The reason for setting up a Hong Kong company is that Hong Kong companies can enjoy a lot of preferential treatment in the mainland.

(4). The fourth floor is a wholly foreign-owned enterprise, which is what we often call WFOE. This establishment is also because the wholly foreign-owned enterprise has some preferential policies.

(5). Looking at the next line, it is a company established by the founder in China that has no controlling relationship with the one on the left. Agreement control is formed between this Chinese company and the fourth-tier WFOE.

The agreement control specifically includes: "Equity Pledge Agreement"\"Business Operation Agreement"\"Equity Disposal Agreement"\"Exclusive Consultation and Service Agreement"\"Loan Agreement"\"Spouse Statement".

Under the VIE structure, profits are generally generated by domestic operating entities, and the path of profit transfer is usually: domestic operating entity → WFOE → Hong Kong company → overseas holding company. Since WFOE is 100% controlled by a Hong Kong company, the Hong Kong company is 100% controlled by an overseas holding company (that is, the Cayman company in the picture above). Therefore, the profit from the WFOE to the Hong Kong company, and further from the Hong Kong company to the overseas controlled company, is done in the form of dividend distribution from the "subsidiary to the parent company".

Rumor: Seeing this, I want to refute the rumor. You will find that the core of the VIE architecture is protocol control. If your company only has this series of holding shares on the left, there is no other domestic company agreement control of this series. Then your company structure is not called VIE.

2. Birth Background

China prohibits or restricts foreign investors from investing in many fields, such as many projects in the telecommunications, media and technology (TMT) industries, but the development of enterprises in these fields requires foreign capital, technology, and management experience, so the VIE structure came into being.

Since the company that first adopted this model is Sina, this model is also called "Sina model".

Rumor refutation: Seeing this, I want to refute the rumor again. You will find that VIE is actually for foreign capital to invest in domestic enterprises, and for the actual operation of this company in China. So if your company takes investment from China and then injects it into an American company for operation, then it is not called a VIE structure.

3. Today is not what it used to be

VIE has had a ten-year history, and it can be said that it is very popular. Basically, everyone starts a company. When they come up, they say "I want to do a VIE structure." But since 2019, many people have come to us to dismantle the VIE structure.

From January 1, 2019, the Cayman Islands has solemnly introduced the "economic substance requirements". All new companies established in Cayman on January 1, 2019 must meet the economic substance requirements. From July 1, 2019, for Cayman Islands companies established earlier, they must also fully meet the economic substance requirements.

So what exactly is this economic substance requirement? It is to meet the substantive operating requirements of the business your company is engaged in.

What does that mean? If you are just a fund company in Cayman, then it is very simple, as long as the investment funds go from Cayman. If you are the top holding company in the VIE structure, then this is a matter of economic substance and documentation. But if you say that it is the main body to be listed in the second layer of the VIE structure, then there are more requirements. Since this is a subject to be listed, the Cayman company at this level needs to carry out actual operations. Both personnel and venues must be maintained at this level of the Cayman company, hiring local people and renting offices in Cayman. This is not possible for many companies.

If this condition is not met, companies in Cayman could face fines, write-offs, or even up to five years in prison for the person in charge.

Is there a way to bypass this rule? The only way is to declare to be a tax resident in the place where your Cayman company actually operates, which means paying tax at a high rate in the country where it actually operates. So whether it is China or the United States, in the face of high taxes, should all companies that want to build a VIE structure think twice before doing it?