Private Equity 20 Lectures (8) CFIUS scrutiny intensifies like never before, AI bears the brunt.

Private Equity 20 Lectures, Silicon Valley Investors' Legal Requirements, I'm U.S. attorney Liu Xiaoxiao.

In the last installment, we introduced the history of CFIUS and its special scrutiny of Chinese investment cases, and in this installment, we'll explain CFIUS's scrutiny standards in detail.

First of all, we would like to explain that the Pilot Program of FIRRMA was enacted during the Trump presidency in 2018, and the Final Rules of FIRRMA were signed by President Biden in September 2022, and these rules came into effect in February 2023, and we will talk about the history of CFIUS and its special review of Chinese investment cases in this issue. Today we are talking about the FIRRMA Final Rules signed by Biden.

Under FIRRMA, there are two types of transactions that need to be submitted for review filing, a control transaction and a non-control transaction.

First of all, I need to make it clear that CFIUS restricts are a foreign investor investing into a U.S. company, which has four elements:

1. investor status

2. investee status

3. the level of control

4. the industry sector of the investee company

The definition of the investee company is the same, which is a U.S. company. As long as the company is registered in the U.S. and actually operates in the U.S. will be recognized as a U.S. company, and the founder's nationality has nothing to do, that is to say, the majority of Chinese entrepreneurs in the United States set up U.S. companies are CFIUS protection of U.S. companies, CFIUS want to limit the non-U.S. capital investment in these companies.

But in the remaining three elements, investor status, the level of control of the transaction and the industry sector is different, so it is divided into control transactions and non-control transactions of these two kinds.

I. Control Transactions

1. Investor - foreign (no exceptions)

There are no exceptions for control transactions, as long as the foreign country is within the scope of review.

2. Definition of "Control Transaction (Controlling Investment)

Note that "control" here is a very broad definition, not more than 50%, but if one party has the right to determine the operations of the other party, it can be considered as "control". The CFIUS Final Rule also gives several examples of "control", such as 7% of the voting power plus the right to terminate major contracts, or 9% of the voting power plus the right to veto (including the termination of senior executives), which may constitute the concept of "control". The CFIUS Final Rule reaffirms the principle of substance over form, stating that a transaction is a jurisdictional control transaction if it "results in, or is likely to result in," control of a U.S. business "regardless of the form of the arrangement".

3. Type of industry -- any industry

Deals that result in a foreign company controlling a U.S. company, regardless of industry, will be scrutinized.

II.Non-control transaction

Investors - Foreign countries (exceptions: Australia, Canada, UK and New Zealand)

The first countries to be included in the exemption list are Australia, Canada, and the United Kingdom, but by February 10, 2023, the U.S. Treasury Department announced that qualified investors from all Five Eyes countries will enjoy an exceptional exemption from CFIUS. But the shareholders of a corporate entity may come from different countries, and it is often difficult to simply determine which country the company belongs to, which CFIUS rules:

1. natural persons. If it is a natural person, then the natural person needs to be a citizen of the exception country and not a citizen of the non-exception country, so for example, if a person is both Japanese (non-exception country) and Australian (exception country), then the exception country requirement cannot be met.

2. The government. If it is a government organization, it must be the government of an exception country.

3. Entity. If it is an entity, then for example all of the following requirements are met: place of establishment. The entity should be established in the United States or an exception country. Principal place of business. The principal place of business of the foreign entity must be located in the United States or an exception country. The board of Directors. More than 75 percent of the board's directors are U.S. citizens or citizens of "exception countries." A single shareholder holding more than 10%. Any single shareholder holding more than 10% must be a citizen of the United States or an exception country. Note that this does not mean that more than 10% of the total shareholders must be citizens of the exception country, but that if a single shareholder holds more than 10% of the shares, it must be citizens of the United States or the exception country. Experience it for yourself. Total equity. At least 80% of the shares are owned by shareholders who are citizens of the United States or other countries.

The question naturally arises, that is, when defining equity, will it penetrate to the actual beneficiaries of the end, then the answer is not a black and white result, the more harmful to the security of the United States, the more likely it is to penetrate, and the more likely it is to penetrate more layers, if there is indeed a high likelihood of threatening the national security of the United States, There's a good chance it will penetrate to the last layer. And the considerations are very comprehensive:

Country of incorporation and residence of the investment entity Background and scope of operations of the owner and controller of the entity and its capital structure investors past business relationships with companies with critical infrastructure, technology, or sensitive data, including compliance and transparency of joint venture capital investment entities in the United States,

In addition, CFIUS also has the right to use other means to judge foreign investors and their interests behind the system, such as through investigations and intelligence gathering, so then it is very difficult to hide, but also think about it even if the surface of the GP have been living in the United States for decades and have joined the U.S. citizenship of the old Chinese, to penetrate one or two layers tend to be dug out some of China's capital background, so actually as long as the elders have a Chinese face is basically a potential target of scrutiny. In fact, as long as the elders have a Chinese face, the investors are basically the potential targets of the review.

"Definition of Non-Control Investment

A transaction is subject to CFIUS jurisdiction if the investor acquires any of the following rights. These rights include:

the right to obtain "material non-public information" (MNI)

the right to nominate directors or board observers

the right to participate in the "substantive decision-making" of the business in ways other than through the exercise of voting rights.

The scope of this is very broad, the first major non-public information, in fact, any company shareholders, even if only 1% of the shares that are given by law the most basic right to know, want to get the company's major non-public information, the 1% of shareholders to the company's management to go to the management can not not give. The board of directors or observers is also, we previously in the "venture capital provisions of the essence of the" also said that the board of directors, the board of directors observers and advisory board of directors of the three roles, which the stronger the front, the weaker the back, the board of directors has the right to vote, the observers are allowed to participate in the meeting but can not vote, the advisory board of directors is only at the invitation of the board of directors to participate, the board of directors can only be invited to participate in. The board of directors can only participate if invited by the board of directors, now the first two are restricted, leaving this last advisory board without any real power is the case of foreigners will not be checked yet. This last one participates in substantive corporate decision-making in other ways, and that's a much broader scope.

So as you can see from this section, any foreign investor that has any small role that can play in the decision making of a U.S. company, that's going to be scrutinized.

Types of Industries - TID Industries

a. Critical Technology

There are six broad categories under this type, Defense, Exports, Energy, Nuclear Materials, Agricultural Pharmaceuticals, Emerging and Basic Technologies. Among them

Most of our Chinese entrepreneurs are most worried about this emerging and basic technology, which contains our high-tech elite research areas, such as xxx

The list of emerging and basic technologies is the most worrying one for most of us Chinese entrepreneurs, which contains all our high tech elite research fields, such as xxxx, and the list is constantly being updated because it is a new technology.

(1) Artificial intelligence and machine learning technologies

(2) Location, navigation and timing technologies

(3) Logistics technologies

(4) Quantum information and sensing technologies

(5) Robotics

(6) Hypersonic speeds

(7) Advanced surveillance technologies, e.g., facial fingerprints and voiceprint technologies

(8) Advanced materials, e.g. functional textiles

(9) Biotechnology

(10) Microprocessor technology

(11) Advanced computing technologies

(12) Data analytics technology

(13) Additive manufacturing

(14) Brain-computer interface

b. Critical Infrastructure (CI)

TID inside the second classification of critical infrastructure, from the name can be imagined are which what water supply and electricity, oil and gas, ports and terminals airports these.

(1) An Internet Protocol network that can only access all other Internet Protocol networks through unsettled peer-to-peer interconnections; or a telecommunications or information service as defined in the Communications Act of 1934, as amended

(2) Internet exchange points that support public peering interconnections

(3) submarine cable systems required to be licensed under the Cable Landing License Act of 1921, including associated submarine cables, submarine cable landing facilities, and facilities to perform network management, monitoring, maintenance, or other operational functions of such submarine cable systems

(4) Submarine cables, landing facilities, or facilities that perform network management, monitoring, maintenance, or other operational functions

(5) Data centers located at submarine cable landing sites, landing stations, or terminal stations

(6) Satellites or satellite systems that provide services directly to the Department of Defense or its components

(7) Industrial resources, as defined in the National Defense Authorization Act for Fiscal Year 1996, as amended

(8) Manufacturing facilities, as defined in the National Defense Authorization Act for Fiscal Year 1996, as amended

(9) Specialty metals, specified materials, chemical weapons antidotes, carbon steel, alloys, and armor plate manufactured in the United States

(10) Specified industrial resources other than commercial off-the-shelf items, as defined in the National Defense Authorization Act for Fiscal Year 1996, as amended

(11) Systems, as defined in the Federal Power Act, including facilities of a large-scale electric power system used to generate, transmit, distribute, or store electric energy

(12) Electricity storage resources that are physically connected to a large-capacity electric power system

(13) specified facilities on military installations that provide for the generation, transmission, distribution, or storage of electric energy

(14) Specific industrial control systems

(15) High-capacity oil and gas refineries

(16) Crude oil storage facilities capable of storing 30 million barrels or more of crude oil

(17) Liquefied natural gas import and export terminals

(18) Specified systemically important financial market utilities designated by the Financial Stability Oversight Council under the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended

(19) specified exchanges registered under the Securities Exchange Act of 1934, as amended

(20) Specified technology service providers that provide core processing services under the Federal Financial Institutions Examination Council's Critical Service Provider program

(21) Rail lines and associated connections designated as part of the Department of Defense Strategic Rail Corridor Network

(22) High-capacity interstate oil pipelines

(23) Interstate natural gas pipelines with an outside diameter of 20 inches or more

(24) High-capacity industrial control systems

(25) Specified airports

(26) Specified seaports

(27) Specified public water systems and military installations

(28) Specific industrial control systems used by public water systems or treatment plants

c. Sensitive Personal Data (Sensitive Personal Data)

Sensitive data that is easier to understand. In fact, TikTok is to suffer a loss in this article, as early as the Trump administration when the U.S. telecom operators, app stores to stop business dealings with TikTok, so as to achieve the ban on TikTok.2021, Biden took office after the withdrawal of Trump's executive order to ban TikTok. At the same time, however, Biden instituted a comprehensive security review of foreign apps.2022 In September 2022, Biden upped the ante by then issuing an executive order directing CFIUS to give weight to the "risks posed to the sensitive data of U.S. users" when reviewing foreign investments.2023 In September 2024, Biden issued an executive order directing CFIUS to review foreign investments in the United States.

Beginning in February 2023, the House and Senate each introduced bills giving Tiktok two options: spin off and sell its U.S. operations, or be blocked. This is why we saw news online some time ago about TikTok's CEO, Zhou Shouzhi, being grilled in a US hearing.

(1) Financial data that can be used to analyze or determine a person's financial distress or hardship

(2) Specific consumer report data

(3) Data sets from health insurance, long-term care insurance, professional liability insurance, mortgage insurance, or life insurance applications

(4) Data relating to an individual's physical, mental, or psychological health status

(5) Non-public electronic communications, including emails and chats

(6) Geolocation data collected using positioning systems, cell phone towers, or WiFi access points

(7) Biometric enrollment data, including facial, voice, retina/iris, and palm/fingerprint templates

(8) Data stored and processed for the purpose of generating state or federal government identification cards

(9) Data regarding the status of security clearances for U.S. government personnel

(10) Data sets from applications for security clearances for U.S. government personnel or applications for employment in positions of public trust

(11) Personal genetic testing data

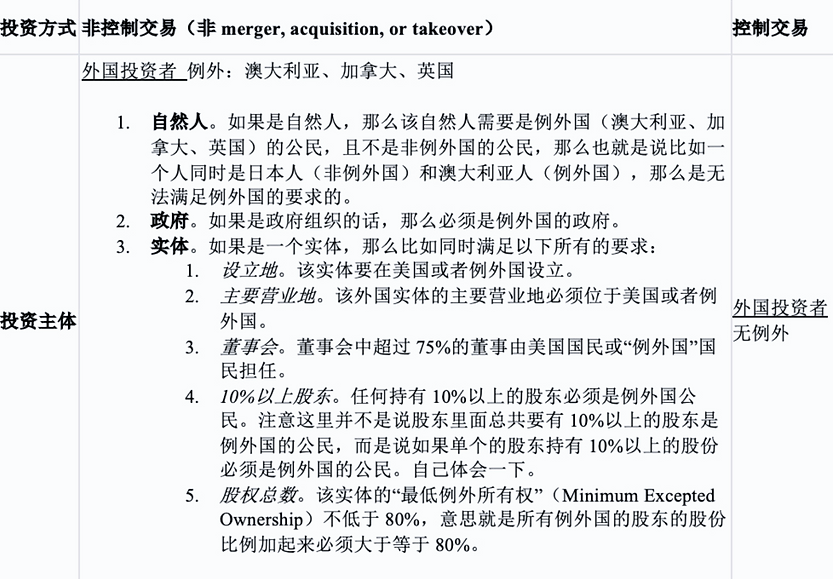

Knowing that the preceding points on control and non-control transactions are very trivial, I have summarized them in this at-a-glance table, which you can take a screenshot of and save to study over and over again.

III. What kind of transactions are subject to "mandatory review"?

We must be very frightened by all the foregoing, but in fact, we should note that most of the transactions are voluntarily declared, and only a very small number of "substantial interest" transactions in TID US companies are mandatory to declare. The so-called "substantial interest" here means that the foreign government has 49% or more of the voting rights in the foreign investor and the foreign investor has 25% or more of the voting interest in the TID business. I will not elaborate on the definitions of 49% and 25% of this place, but there is also a detailed map, which members can take screensaver and read repeatedly.

Here, 25 percent voting power is a blanket measure; 49% is a national government or a sub-government that directly or indirectly holds 49% or more of the interest in the General Partner. The regulation lists two cases for reference:

(1) Example 1. Foreign company A plans to acquire 30% of the voting rights of Company X, an unaffiliated TID. Company B holds 51% of the voting rights of Company A and is the parent company of Company A. Foreign governments hold 75% of the voting rights in Company B, with private, non-government controlled individuals holding the remaining 25%. According to the regulations, Company B is considered to have 100% of the voting rights of Company A because it is the parent company of Company A, so the foreign government's indirect voting interest in Company A is presumed to be 75%. Company A is acquiring A significant interest in Company X, and the foreign government has a significant interest in Company A.

(2) Example 2. The same fact as in Example 1, except that Company B holds only 49% of the voting rights of Company A and is not the parent company of Company A. Since Company B is not the parent company of Company A, Company B cannot be considered to have 100% of the voting rights of Company A, but rather 49% of the voting rights.

IV. What will happen to the companies under review?

So what should companies under scrutiny do? In fact, there are two ways out, or should be two endings, one is to reduce the negative impact of continuing the investigation on the company and withdraw the previous application, to be revised and supplemented and submitted again (in fact, consider changing American investors, do not find foreign investors to invest); Another option is to sign a mitigation agreement with CFIUS, which would take steps to reduce foreign investors' control over a company and prevent them from accessing important information about a U.S. company.

In fact, both of these basically lead to the damage of the investee companies, and often the companies that are reviewed by CFIUS will shut down because of the drying up of capital. In the face of CFIUS review, the only thing we Chinese entrepreneurs can do is to choose pure American investors as far as possible when choosing investors, so as to reduce the risk of being reviewed.

Private equity 20 lecture, Silicon Valley investors legal compulsory course, I am American lawyer Liu Xiaoxiao.